DRIVEN BY RESULTS,

COMMITTED TO EXCELLENCE.

Your All-in-One Class Action Attorneys

OVER $1B RECOVERED

FOR CONSUMERS NATIONWIDE.

Shamis & Gentile, P.A. consistently delivers outstanding legal services nationwide. We stand out for our extensive experience, expertise, and resources, allowing us to handle a wide range of cases, including class actions, mass torts, and mass arbitrations.

Our Values

Results-Driven:

No fees until we win.

Integrity:

Transparency, consistent, and cohesive communication every step of the way.

Excellence:

We work tirelessly and quickly until we deliver the results you desire.

Client-First:

As your trusted partners, we are committed to servicing you around the clock, every day.

Class Action Investigations

When you choose us to be your class action lawyers and attorneys, there are no fees or expenses unless we manage to win the case on your behalf.

Data Breach

Bank Overdraft Fee

Spam Text Message

Total Loss Car Accident

Success Stories

Shamis & Gentile, P.A. has Won Eight Figure

Settlements for our Clients

Eight Figure

Settlements for our Clients

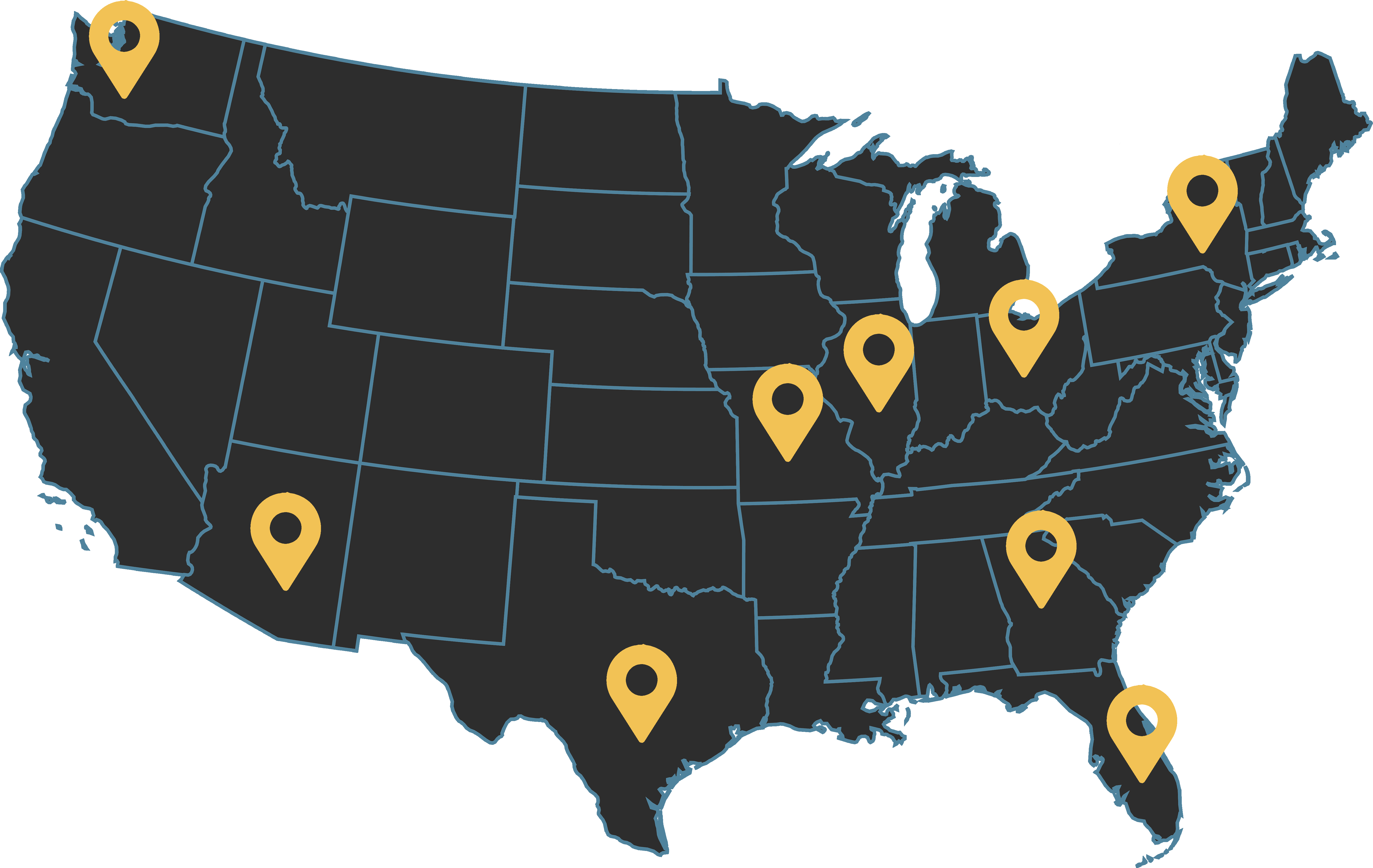

NATIONWIDE

Outstanding legal services to class members across the country. Attorneys licensed in Florida, New York, Texas, Georgia, Ohio, Illinois, Arizona, Missouri, and Washington.

We have recovered over $1billion with over 100,000 cases litigated.

$12.5

Million

Class Action

$2.85

Million

Class Action

$2.85

Million

Class Action

$2.75

Million

Class Action